change in net working capital dcf

V1543 Jun 19 2022. When snap-to-nearest enabled via right-click menu or occurs via shift-click in waterfall.

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

D Cost of working capital Answer.

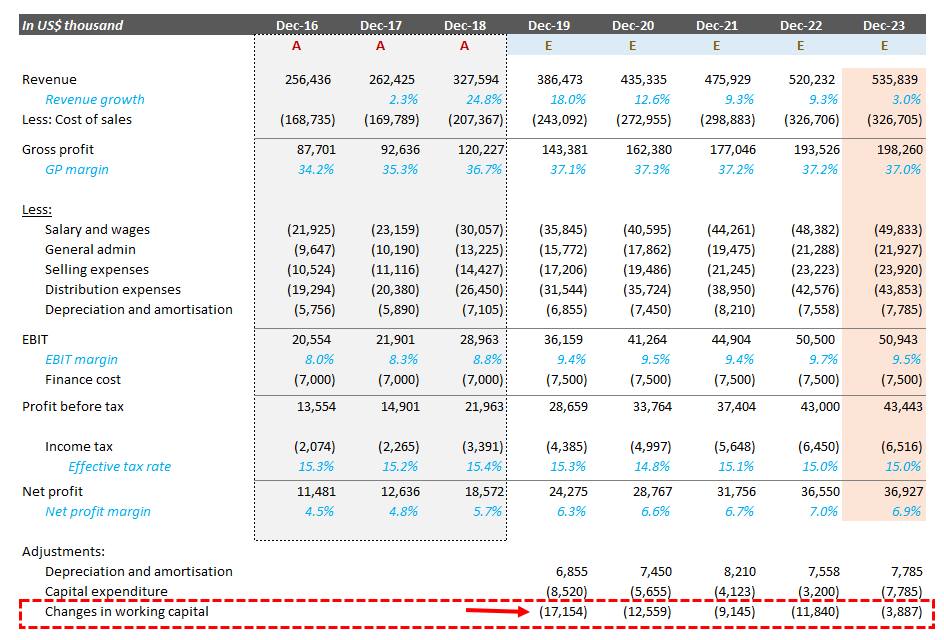

. On the other hand if the company is unable to produce positive working capital then the company has to take. Similarly change in net working capital helps us to understand the cash flow position of the company. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash.

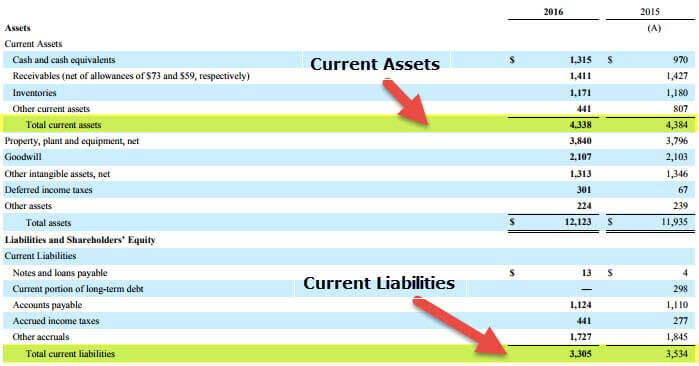

Walmart DCF Corresponds to this tutorial and. Net Working Capital Total Current Assets Total Current Liabilities. Common Criticisms of the DCF and Responses And here are the relevant files and links.

A balance sheet is a financial statement that summarizes a companys assets liabilities and shareholders equity at a specific point in time. DCF Model Step 2. Accounts Receivable AR 80 million.

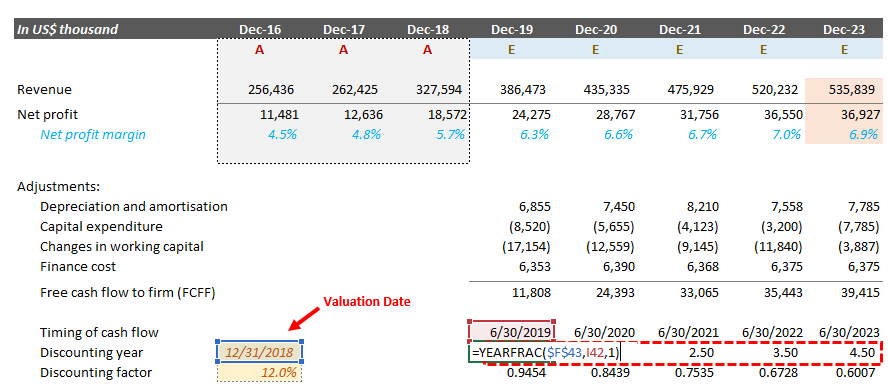

Cash Flow from Operating Activities Depreciation Schedule Straight Line Depreciation Amortization of Intangible Assets Change in Net Working Capital NWC Accounting for Capitalized Software Costs Salvage Value. Changes in working capital. Forecast over a set time horizon.

For the working capital schedule and fixed assets forecast the following assumptions will be used. Cash and cash equivalents are part of the current assets section of the balance sheet and contribute to a companys net working capital. Walk me through a DCF.

Louise Cummings who established the Ballard Community Fund at the DCF in memory of her husband the late Corporal Stephen Ballard. Based on the results of the Net Present Value a company may decide on investing in one project and. For Austravel Net frequencies show base names when their selcalls are used.

Your discount rate expresses the change in the value of money as it is invested in your business over time. Net Present Value is used by companies in capital budgeting decisions to decide which investment they would rather do. C Calculate the present value of the net cash inflows by using an appropriate discount rate.

Positive net working capital is resultant when a company has enough current assets over its current dues. Peter Thiel once stated The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined The return distribution that Thiel is referring to is known as the power law of returns where the majority of early-stage investments are made under the presumption that. Learn financial statement modeling DCF MA LBO Comps and Excel shortcuts.

DCF analyses use future free cash flow projections and discounts them using a. A DCF is one of the most important methods of determining a companys worth so your interviewer will want to ensure youre highly knowledgeable about it. So a positive change in net working capital is cash outflow.

The Discount Rate 2846. The VOC was also the first recorded joint-stock company to get a fixed capital stock. Working with the Delaware Community Foundation Im able to do the charitable work I want to do without the administrative costs and responsibility of a private foundation.

C Overall cost of. A List the annual sales and cost other than depreciation and reducing the latter from the former obtain the net cash flow. Fix passband initialization bug that occurs under certain circumstances.

A working capital formula is extensively used in a business to meet short-term financial obligations or short-term liabilities. Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity. As stated above net present.

However we add this back into the cash flow statement to adjust net income because these are non-cash expenses. Our essay writing services will help you when nothing else seems to be working. Whenever students face academic hardships they tend to run to online essay help companies.

Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. Next well calculate the invested capital which represents the net operating assets used to generate cash flow. Corporate Finance wörtlich deutsch Unternehmensfinanzierung ist der Anglizismus für ein Spezialgebiet der Finanzwirtschaft das sich mit Fragen zur optimalen Kapitalstruktur zur Dividendenpolitik eines Unternehmens sowie der Bewertung von Investitionsentscheidungen und der Ermittlung des Unternehmenswertes auseinandersetzt.

If this is also happening to you you can message us at course help online. Add Austravel Net channel numbers to the Selcall frequency menu. If the change in NWC is positive the company collects and holds onto cash earlier.

B Obtain the capital investment cost. Therefore the companys asset size has increased by 274 during the year. DCF Model Step 3.

These three balance sheet segments. Inventories 50 million. The Terminal Value 3415.

Then Calculate the Net Present Value which can be used to decide which opportunity is better and should be invested in. Working capital represents the difference between a companys current assets and current. Percentage Change 274.

DA reduces net income in the income statement. For example if your company produces a plan for calendar year 2018 a rolling forecast will re-forecast the next twelve months at the end of each quarterThis differs from the traditional approach of a static annual forecast that only creates new forecasts. Percentage Change 375 million 365 million 365 million 100.

Venture Capital Due Diligence Overview. The Dutch East India Company also known by the abbreviation VOC in Dutch was the first publicly listed company ever to pay regular dividends. However if the change in NWC is negative the business model of the company might require.

Net working capital 106072 98279. We will ensure we give you a high quality content that will give you a good grade. Corporate finance for the pre-industrial world began to emerge in the Italian city-states and the low countries of Europe from the 15th century.

Net working capital 7793 Cr. Today is the day the dust on the topic of changes in working capital finally settlesRead this page slowly and download the worksheet to take with you because the whole topic of changes in working capital is very confusing. Cash Flow from Investing Activities CFI.

The Big Idea Behind a DCF Model 521. A rolling forecast is a management tool that enables organizations to continuously plan ie. Often this will be at present value because the amount spent is invested in the base year.

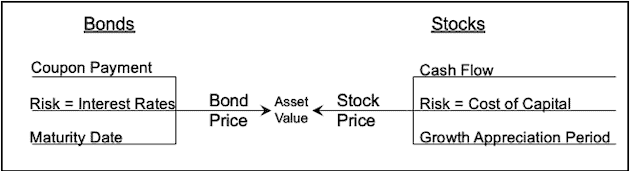

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. B Cost of common stock. In finance a discounted cash flow DCF analysis uses the time value of money to value a project company or asset.

Accounts Payable AP 40 million. In other words no cash transactions are involved. When specific costs are combined then we arrive at A Maximum rate of return B Internal rate of return C Overall cost of capital D Accounting rate of return Answer.

Net working capital is equal to current assets less current liabilities. Percentage Change Formula Example 2. What is Change in NWC.

Working capital is important for funding a business in the short term 12 months or less and can be used to help finance inventory. DCF Model Step 1. Spreadsheet includes examples calculations and the full articleIts taken a lot of thought over many years to fully understand this idea of what the.

Let us take the example of Apple Incs share price over the last seven trading days to illustrate percentage change. Unlevered Free Cash Flow 2146. The cost of equity share or debt is called specific cost of capital.

You need to know your NPV when performing discounted cash flow DCF analysis one of the most common valuation methods used by investors to gauge the value of investing in your business.

Discretionary Cash Flow Financial Edge

Negative Working Capital Formula And Calculation

Retail Investor Org Valuing Stocks Using The Discounted Cash Flow Dcf Model Investor Education

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Net Working Capital Guide Examples And Impact On Cash Flow

Change In Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital From A Metric To The Valuation Of A Firm

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Dcf Model Full Guide Excel Templates And Video Tutorial

Changes In Net Working Capital Step By Step Calculation

Changes In Working Capital And Owner Earnings The Complete Guide

Dcf Valuation For Microsoft Msft 58 Upside R Canadianinvestor

Dcf Model Full Guide Excel Templates And Video Tutorial

Valuation Of A Firm Ppt Video Online Download

Non Cash Working Capital A Critical Component Of Valuation And Fcf

Dcf Craft Part 1 2 Of 5 Free Cash Flow Projection

Learn How Our Reverse Dcf Model Works

Discounted Cash Flow Model Dividend Discount Models Multiples Valuation Mu Investment Club Spring Ppt Download